Before we spend too much time in the bank-bailout hearings arguing about CEO salary caps and the types of hedge funds to be banned, let's think about root causes, shall we? How about banning any sustained profit margins above some arbitrary cap like 12 percent? Socialism, you say? No more so than nationalizing an insurance giant like AIG. And something tells me even Adam Smith might understand the point. Bear with me.

Before we spend too much time in the bank-bailout hearings arguing about CEO salary caps and the types of hedge funds to be banned, let's think about root causes, shall we? How about banning any sustained profit margins above some arbitrary cap like 12 percent? Socialism, you say? No more so than nationalizing an insurance giant like AIG. And something tells me even Adam Smith might understand the point. Bear with me.Before the S&L shell games and leveraged buyouts of the mid-1980s, investors were happy with regular profit margins for goods and services in the 5 to 8 percent range, with occasional surges into double digits when a buying craze hit anything from tulips to Teenage Mutant Ninja Turtles. The important thing was, the surges were related to specific goods and services over which the public at large went temporarily mad.

The common thread in short-sells, derivatives, collateralized debt obligations, hedge funds, vendor-financed Internet infrastructure, commodities speculation, et. al., is that investors seek and expect continuous profits in the 12 to 20 percent range. These kind of expectations killed the media industry. And in the case of financial instruments, they are seeking profits from bets waged on future market behavior, not on tangible goods and services. Excess profits are being conjured out of thin air. Sounds like a RICO violation to me!

Wait a minute, you say, how can excess greed be criminalized? Doesn't that destroy capitalism? Hell, no. Regulating externalities like labor rights and environmental factors not only has a long history, it has been critical to controlling capitalism to prevent it from being self-destructive. China's recent experience with losing control over additives in its food supply shows that early efforts like the Pure Food and Drug Act of 1906 were key to taming the capitalist beast.

When I was out walking the dog at 5 a.m. this morning, I was dreaming up advertising campaigns. Haul some Jenny Craig slim-down pictures out and say, "Wall Street: Slim down your profit footprint!" -- thereby linking the notion of excess profits to the carbon-footprint ideas of the environmental movement. And, of course, use the Monopoly symbols of the angry cop to insist: "Profit margins over 12 percent? Go directly to jail!"

9 comments:

I don't know enough econ to know what your proposal would do, but it seems like a fair cap, and as you say, now that we have socialized AIG, everything's on the table as far as I'm concerned (and I tend to think like a socialist anyway).

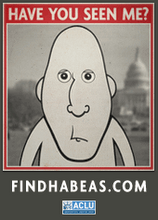

As usual, Tom Tomorrow has the best ideas:

http://action.credomobile.com/comics/2008/09/financial_meltdown.html

Yep, that about sums it up. Have you seen Fed Up USA with Karl Denninger yet? I don't know anything about him, but this is pretty funny/sad. We saw him on NBC nightly news last night:

http://www.fedupusa.org/

I would go further and propose an insurance fund to be paid into out of profits, with a percentage that reflects the cost of buyout. I have to do it as an FHA homebuyer and I'm much less of a financial risk. 'Everyone plays by the same rules'or a similar populist message. Are you the lobbyist?

In addition to the profit cap...

and interest on the insurance fund can go into social security...

I have nothing to offer in the way of practical critique to setting profit caps but am interested in listening, and also found your friend Lee's email interesting.

Nothing like stating the obvious but these issues are (in my brain) indicative of much larger cultural issues and skewed priorities. So, rather than keep talking unnecessarily I'm going to leave you with words that Jody posted today. They seem apropos

*********************

the moment is coming.

tearing everything in half

is necessary. things will spill

onto the floor. marbles

shall fall and scatter, rolling

against toes, under furniture,

milling out the door..........

until nothing original

is still recognizable anymore.

To read her entire piece go to:

http://sonotcool.typepad.com/day

book/

Well, Ruth, at least I agree with Karl Denninger's "voiding of derivatives contracts" idea. I'll have to study him a lot more...

Jess, yes, yes, and yes....

Sharon, I love Jody's full post, and you're right, Lee had gobs of good ideas.

We have been talking/thinking about this a lot lately around here (as have many people). That does seem more balanced - profit caps, executive salary ceilings and things of that nature. It seems too much big biz is already in bed with government though, and so to make big change seems impossible without just severing all current political representation and starting from scratch! ;) Uh, not likely though. Interesting ideas.

Post a Comment