It was pretty easy to skip by the stories emerging from Dec. 12 on, regarding Bernard Madoff, former head of NASDAQ, and one of New York's most respected brokers. So he was running his hedge fund as a Ponzi scheme - aren't all hedge funds Ponzis by nature? Pay attention. Madoff lost more than $50 billion for big-name clients like Steven Spielberg and Elie Wieisel, for huge charities that have now seen all their money disappear, and for large international banking conglomerates like Nomura Securities.

It was pretty easy to skip by the stories emerging from Dec. 12 on, regarding Bernard Madoff, former head of NASDAQ, and one of New York's most respected brokers. So he was running his hedge fund as a Ponzi scheme - aren't all hedge funds Ponzis by nature? Pay attention. Madoff lost more than $50 billion for big-name clients like Steven Spielberg and Elie Wieisel, for huge charities that have now seen all their money disappear, and for large international banking conglomerates like Nomura Securities.European banking officials told PRI's The World Dec. 15 that this single scandal could be the straw that finally freezes up the international movement of currency and commercial paper. Then we can all turn the fingers away from Bush, Paulson, Obama (if you're so inclined), bankers, unions, whomever, and zoom them all in at one pyramid-scheme pusher from Manhattan. While the Securities and Exchange Commission is not tasked with looking at hedge funds, the SEC had two chances to pop Madoff and did nothing.

Three observations: People stupid enough to invest in a pyramid scheme love to blame the victim. Witness the riots against the Colombian government for correctly trying to shut down an outrageous pyramid. Hello dummies, it's your fault. Second, when we hear of children turning in their parents, it's usually with visions of Stalinist Young Pioneers sending mommy and daddy to Siberia. In this case, Madoff's sons did the right thing by busting their father. I wish that we could convince people like the late great civil-war author Shelby Foote that blood should never be thicker than the rule of law. If members of your immediate family are capital criminals, call the cops. Finally, folks usually like to refer back to the crash of 1929 or the post-railroad crashes for similarities to past crashes, but this current financial mess looks surprisingly like the British specie collapse of 1825, and the U.S. real-estate collapse of 1837. See The Birth of the Modern and What Hath God Wrought for more details. See? None of this is new. We just don't learn our lessons very well.

6 comments:

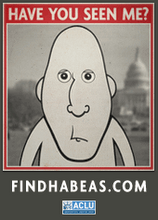

For a trip, visit Madoff's home page.

All in black, too! Quite a feeling of finality.

Hi Loring, David Loves the flat black and circular record store.When we visit the west side of the state that is always a stop! David's musical taste is so unusual. He mainly listens to european experimental music. Very unusual stuff for the selective listener. Oh,Dave is a curmudgeon too.

European older experimental stuff like Can, or newer people like Ashtray Navigations or My Cat is An Alien? Does he like any US side of the pond people like No-Neck Blues Band, Pelt, Charalambides? Ask him if he knows about Heather Leigh Murray's wonderful Glasgow site for experimental music, www.volcanictongue.com. But don't let him spend the family savings....

Some of David's favorites are Hafler trio,Nurse with Wound,neu,kluster. Charalambides played at a local at a small record store owned by Wendy and Carl,Stormy Records.Are you a collector? You are both a rare breed... not a lot of people out there? Dave is a blog virgin,but he is going to write you tonight. There is a major winter storm in Mi. right now so.... We recently saw Cluster at the DIA

Love Cluster and NWW. David would get a kick out of a side project of Charalambides called Abrasion Ensemble, that did a CD called "Music for the Same 50 People." That about sums it up! Anyway, feel free to just write direct at lwirbel@aol.com or lwirbel@gmail.com, any time.

Post a Comment