Ben Bernanke seemed to violate the first rule of bad-example debtors when the Federal Reserve announced March 11 it would create a $200 billion fund for the banks and securities institutions who found themselves in liquidity crises for doing very stupid things with other people's money. But before I worked up my sense of moral outrage, I wondered if maybe there were bad credit-card purchases for which I could seek forgiveness by taking out a small loan from the Fed. Oh sure, dumb music and over-hyped vacations, but nothing compared to a Countrywide Financial Corp. ski trip to Colorado.

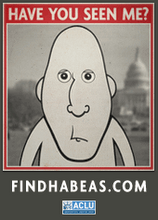

But wait a minute, there are certainly formerly squeaky-clean state governors who could use some help! And Eliot Spitzer already has a working relationship with Bernanke for all the corporate crime he's fought! C'mon, Ben, don't trips to the Emperor's Club deserve some liquidity forgiveness? Eliot sure looks like he could use a break.

2 comments:

Long overdue for a comment, and I just finished this post and your EE Times post calling out Krugman's column.

Yes, Krugman IS a whiny liberal (I call him AngerMan) but damned if he doesn't have a point for once.

I will take issue with his poo-pooing of the $200 million safety net: Yes, there are $11 trillion in mortgages outstanding in the U.S., but I have to believe that a fraction of those are held by people who never should have gotten a mortgage in the first place. Most Americans, I would argue, have jobs and pay their mortgages on time.

Now if the whole thing melts down, we're all in trouble. And maybe that's what he's alluding to. But I'm not a big fan of government bailing out banks with shitty lending practices.

No one, clearly, knows the extent of this problem. No one in government is leading the charge or trying to reassure people (think Roosevelt's soothing voice versus Bush's un-reassuring drawl).

Were FDR alive right now, he'd dust off the "fear itself" speech because we're experiencing something that used to call, in teh 19th century, a Financial Panic.

The Spitzer incident is instructive. The sub-prime crisis could be solved by having mortgage holders who are in default post their songs on their Facebook pages and pose nude for Hustler or Playboy, a la "Kristen." The money that rolls in should cover all costs.

Krugman may be whiny and angry, but at least he bases his whiny assertions on actual research. We all know the range of value of "research," but research is still more reliable than the average idiot's gut, and we have an exceptional idiot's gut running the country at the moment.

Those malicious bastards on Wall Street deserve whatever devastation they've visited upon themselves, but for the likelihood they will take the rest of us down with them. Their perfidy is exacerbated by their knowledge that they can get away with so much, because the rest of us can't afford to let them fail as spectacularly as they inevitably do every other generation or so.

Which, oddly, brings us back to Spitzer. He may have been a disaster as a governor, but he's the only person I can think of in my lifetime who attacked the Wall Street hordes.

Post a Comment