Normally, I might have cheered Andrew Cuomo's subpoena of Ken Lewis, CEO of Bank of America, for the billions in bonuses issued to at the end of 2008 to executives of Merrill Lynch before the merger. But I was in the middle of the lead article of Foreign Affairs, where Roger Altman tried to explain why bankers behaved the way they did, competing to create the dumbest and most unstable instruments possible.

Sure, Altman is going to make a partial defense of bankers, but his explanation makes sense. He sees housing as merely the market of random exploitation, and subprime mortgages as the easiest instrument to exploit. To him, the crisis began with excess global liquidity, and a clamoring among institutional investors and foreign investors for the highest risk possible among instruments (since yield is proportional to risk). If this liquidity had been there during the Internet-infrastructure/dot-com boom of 1999, the meltdown might have happened then. Suddenly, bankers were scrambling to approve as many subprimes as possible, and bundle them into futures contracts. (Yes, I know you're thinking of a prosecutor rolling his eyes as all the drug dealers in town claim, "We had to cut the heroin with Comet cleanser, everyone was doing it.")

I've already made the argument for mandating a cap on rates of return on investment (12, 15 percent?), which may be more important than capping executive salaries. Free-market wankers may whine that the Nanny State is once again trying to dictate the level of risk which can be assumed. But if you run a sky-diving or hang-gliding school and have a couple students who always insist on launching from the most dangerous spot to increase their thrill over the risk involved, in a drive for monoamine oxidase overdose, don't you have a responsibility to say something, at least because of your liabilities? If you run a gun shop and a customer boasts of going home to play Russian roulette, isn't there a cautionary tale? Remember, cops can treat a suicide attempt as a crime, if they wish, because the damage is not limited to the individual, it affects the society at large. And if you become addicted to increasing levels of risk, you will eventually die, run the numbers.

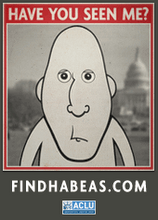

None of this is meant to take the heat off bankers, mortgage brokers, hedge-fund managers, or any of the other links in the chain that led to the meltdown. But the next time some conservative blathers on about Fannie Mae, Freddie Mac, and the Democrats being the sole cause of our problems, or Rick Santelli launches into another mindless rant about how poorer people caught in subprimes were the cause of our miseries, remember the Altman article. A few friends last week mentioned the long-rumored and long-forgotten anonymous conspiracy-theory newsletter, One Great Big Conspiracy. As I watched Cuomo defend his subpoenas, I thought about the apocryphal final issue of OGBC, never finished and never distributed, with a mirror on the cover and the bold declaration, "The problem is YOU." (And me.) Let this be our mantra as we climb out of this mess.

9 comments:

Wow, I am really digging this post and your links. I feel like I am so ignorant of all of this and this has been very helpful. I think Altman's analysis is really good and thorough.

I do have a question that I can't seem to get my head around: What "triggered" this huge downturn to begin with? I can see how people losing jobs or income triggered the real estate mess and how all the bundling of bad mortgages has caused the havoc in the banking industry, but what got this mess spiralling to begin with?

Maybe it needs to be your next post, and not an answer in your comments, or maybe you already have it somewhere and can send me there?

Always feel smarter when I come here!!!

Thanks, Don. This is just my personal guesstimate, but I think we were really lucky that it didn't happen 2000-01, because all the elements were there.

The key is imaginary assets. That kind of happened in the "South Sea Company" bubble in England in the 1720s. With the Dutch tulip bubble, at least there were tulips. With the South Sea Company, they were trading on things that did not exist.

The worst part of the dot-com bubble was not the business plans for dumb Internet companies that would use money to throw parties, but the Internet-infrastructure bubble, where companies would lay fiber based on no demand, and telecom service companies would expand based on "vendor financing" - in other words, Lucent or Nortel would pay the telecom company to install their equipment in their network. Huh? Where was a profit on tangible assets to be made?

I started worrying in the early 2000s when Nobel math laureates began going into hedge funds, which were starting with futures contracts and moving into ever-higher layers of abstraction. If you look at mortgage markets, at some point in the subprime tranching, the banks and their investors were realizing profit over nothing at all. As Gertrude Stein said of Oakland, "There's no there there."

That's why I think all hedge funds are Ponzi schemes, because they are trading assets that are only imaginary. When that starts happening and you reach a point where the underlying physical assets droops in price, the dangers are magnified a million-fold. One lesson that people should take from this crisis is that if they invest in an asset, it should be something they can kick with their foot and stub their toe. Otherwise, they should run away fast.

People think that I am crazy, but I really feel that gas prices played a huge part in this economic nightmare. People, like myself, whose budget did not figure on 50 dollar a tank fill ups for a car with a 12 gallon fuel tank, had to put alot of things on credit to make up the difference. I still have a job and can make all my payments, but I have hurt my future, and I blame it on gas prices.

Oil prices play an indisputable role in EVERYTHING!

Here's a long piece by Michael Lewis that I consider the most lucid explanation of what just happened:

http://www.portfolio.com/news-markets/national-news/portfolio/2008/11/11/The-End-of-Wall-Streets-Boom

Lewis backs up Loring'g guess, that the trigger was when people started selling stuff that wasn't there.

I got nothing good to say about the financiers I met in NYC in the '80s and '90s. I can't imagine the breed has improved any at all. These are not ethical people we're talking about. I suspect many of them had some idea that what they were selling was value-less, and I can't imagine they cared.

Why doesn't the casting of poxes on their houses work any more?

I was surprised reading a recent article in the New Yorker about Ahmadinejad's desire to put oil money on every kitchen table, thereby pouring money into the economy and creating way too much liquidity, leading to the horrific state of the economy there. Real estate is sky high, and besides of course he closes Iran off from outside trade.

This, combined with your post, educated me that too much liquidity is a problem.

Improved vaccines, is my guess

But Ruth, Ahmedinejad is going to run low on money sooner than he thinks, as not even OPEC caps on output are bringing prices per barrel back up to the level he was hoping for to fund programs within Iran. Oh, the unpredictable whirl of strange economic storms over the next few months....

Post a Comment